Does Car Insurance Cover Theft in the UAE?

Which insurance covers car theft?

In the UAE, car insurance covers theft, and it is wise to buy a comprehensive insurance policy for this very reason.

What is comprehensive insurance?

This insurance covers damage to the individual’s car and third-party vehicles, such as fire, theft, collision, etc. Comprehensive car insurance cover is available in the UAE, but not for cars older than seven years.

In the event of any incident, comprehensive insurance will cover all parties involved, including any damage to the vehicle. It also covers a wider range of scenarios, other than vehicle accidents. Third-party liability will cover the insured against damage to another vehicle or property, but it does not include the owner’s car.

No, each insurance provider has specially crafted policies with different modulations. An online comparison can help decide the best policy for a specific vehicle make and model.

Plenty of insurance companies offer a variety of policies that you can easily compare on BuyAnyInsurance in under a minute.

What are comprehensive car insurance add-ons?

At an additional cost, the following add-ons are applicable:

- Theft – for stolen parts or malicious acts like vandalism.

- Fire – for accidental fires or acts of nature.

- Death/bodily injury – for person or property in third-party accidents.

- Personal injury protection – for medical costs of injuries to passengers.

- Oman – for damage to the vehicle when driving in Oman.

- Roadside assistance – for repairs, towing, battery boosts, lockouts, and emergency fuelings during a breakdown.

- Off-road – for driving on unmarked roads within prescribed limits.

- Dealership repairs – for repairs from authorized dealerships.

- Zero depreciation – for the entire cost of a claim without accounting for the vehicle’s depreciation. Only for vehicles not older than 6 months.

- Loss of personal items – for damage to personal property inside the car during an accident, fire, theft or attempted theft.

What is the extent of comprehensive insurance cover in theft scenarios?

Let’s explore the following scenarios to better understand what comprehensive car insurance covers during theft or attempted theft.

Damage to the car as a result of a break-in:

Comprehensive insurance covers this scenario. The insurance will cover repair costs such as broken locks, shattered windows, or a busted ignition system.

Theft of car:

Comprehensive insurance covers this situation. The policy will recover the vehicle’s value.

Theft of personal items from the car:

Without any add-ons, a comprehensive insurance policy will not cover this circumstance. However, as mentioned above, if an owner applies for an add-on for an additional cost, they will be included.

Theft of vehicle upgrades:

Car insurance cover will not include custom parts such as custom paint jobs, grills, navigation systems or stereo upgrades, and anything else that the original manufacturer didn’t install. It is best to discuss these with the insurer beforehand to agree on limits, insurance cover and how to best protect the customizations. It’s also a good idea to keep a record of every upgrade made to your vehicle and save your receipts.

Theft of car with pending loan payments:

Under the insurance cover, the insurer will pay the Actual Cash Value (ACV) of the vehicle minus the deductible. The ACV is the market value based on pre-loss condition, age, options, mileage, etc. The amount might not be enough to pay off the loan since vehicles depreciate quickly, in which case consider purchasing Gap Cover.

What is Gap Insurance Cover?

Guaranteed Asset Protection is an add-on that pays the difference between the ACV and the owed amount. It is only purchasable with comprehensive insurance and for cars less than 6 months old.

What are the steps to follow after a loss due to car theft?

Immediately file a police report if the car isn’t misplaced, towed due to illegal parking, repossessed, impounded or claimed by a creditor. Responding as quickly as possible is imperative for recovering the stolen vehicle or initiating a smooth claims process.

File a police report

File a report as early as possible, ideally within 24 hours of the theft. While this improves the chances of recovering the vehicle, it is also imperative in order to submit a claim to the insurance provider. Have the following information in hand to provide to the police:

- The Vehicle Identification Number (VIN) and the license plate number.

- The year, make and model of the car.

- The place and estimated time of the theft.

- The identifiable marks of the car, such as paint, stickers, dents, and any tracking devices.

File an insurance claim

Alerting the insurance provider of the loss of a vehicle as early as possible is pertinent, regardless of the insurance policy. However, the following information is requisite to make a claim:

- Certificate of Title for the vehicle.

- Location of all keys to the vehicle before and after the theft.

- Names and contact information of accessors to the vehicle.

- Description of the vehicle, including mileage, options, service records, and upgrades, including receipts.

- A list of personal property stolen from the vehicle.

- Any financing information and the payer’s account number.

- Credit report to prove significant financial standing and dismiss fraud.

Notify existing financers of the car

If the car is under leasing or financing, notify the appropriate authorities immediately.

What happens after the recovery of the stolen vehicle?

Parts are missing or damage is done to the vehicle:

The insurance company will decide if the damage is worth fixing, or if the car is a total loss. If the damage is worth fixing, and the owner has a comprehensive insurance cover, the insurance company reimburses the cost of the repairs minus owed insurance deductibles. If the car isn’t worth saving the insurance company pays the ACV minus owed insurance deductibles.

The insurance claim is already paid:

In this scenario, the recovered car becomes the property of the insurance company. However, if the amount isn’t already spent, simply return the claim amount. The insurance provider handles this on a case by case basis.

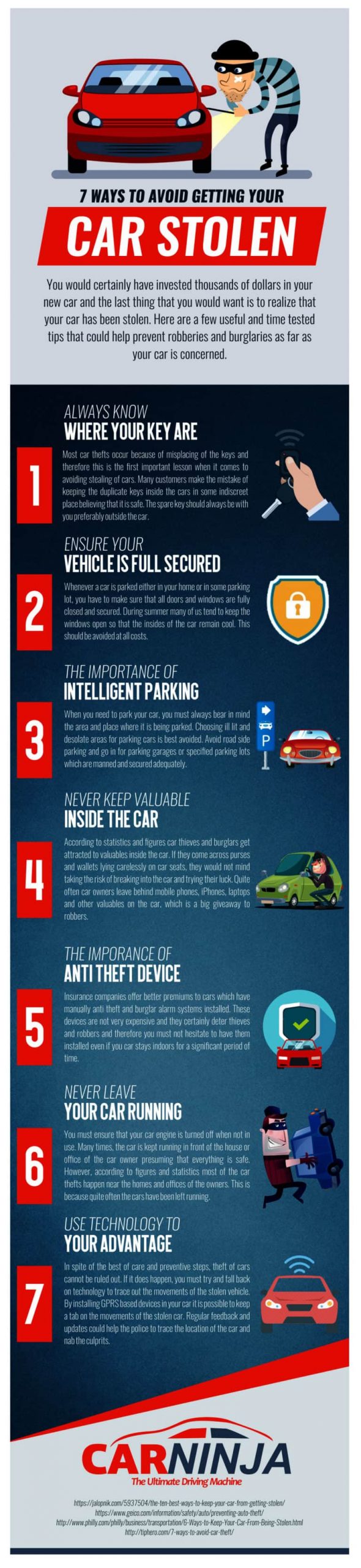

What are the important tips to avoid car theft?

1- Hide valuable items in the car

Lock and conceal valuable items in the trunk of the car.

2- Park at safe spots

Avoid parking in dark or secluded areas and always keep the doors locked.

3- Keep a list of important documents

Keep a file of serial numbers and receipts for high-value items such as cell phones, jewelry, bicycles, etc.

4- Install tracking devices

Install tracking or anti-theft devices such as a steering wheel lock.

In addition to precautions to help protect a vehicle, purchase comprehensive insurance cover for peace of mind. Call us at 800 POLICY if you have questions or enter your details below.

FAQ’s

What is comprehensive car insurance in UAE?

A comprehensive car insurance policy in Dubai covers the following: The policy covers the damages caused to the insured vehicle due to accidents, collisions and natural disasters. Any damage caused due to the fire breakout, explosion or self-ignition. Damage of car windshield or other glass damage.

Is car insurance compulsory in UAE?

According to the UAE government RTA law, it is mandatory for all car owners to get car insurance cover.

Read Also:

Car Insurance Cover in UAE: The Complete Guide for Smart Buyers

8 Common Mistakes to Avoid While Buying Car Insurance

These Factors Will Change Your Approach to getting Car Insurance in Dubai

Contact Us:

Originally published Feb 20, 2020 14:04:40 PM, updated May 08, 2024