List of Best Car Insurance Companies in Dubai and the UAE

So, following is a list of all the car insurance companies in Dubai and the UAE, and underneath we will touch on the details of the popular car insurance providers. You can get cheap car insurance in Dubai online, if you’re aware of various aspects of car insurance policy in Dubai.

In this way, you can get the Best Car Insurance Companies in Dubai. Whether you’re buying new car insurance or renewing the existing car insurance policy in Dubai. A Good awareness of car insurance policy, calculation, and car insurance companies in UAE is a must. However, before we begin, let’s take a look at this important and informative video by the UAE Insurance Authority:

The Complete List of Car Insurance Companies in the UAE

You can check the car insurance Dubai prices online on a few clicks to the car insurance portal. Please note that this list is compiled in alphabetical order:

- Abu Dhabi National Insurance Company

- Abu Dhabi National Takaful Co. PSC

- Adamjee Insurance Company Ltd.

- AIG Insurance Company

- Al Buhaira National Insurance Company

- Al Fujairah National Insurance Company

- Al Hilal Takaful

- Al Sagr National Insurance Company

- Al Wathba National Insurance Company

- Alliance Insurance

- AMAN Insurance

- Arabia Insurance

- AXA Insurance

- Clements Worldwide

- Dar Al Takaful

- Dubai Insurance

- Dubai National Insurance & Reinsurance PSC

- Emirates Insurance Company

- i-Insured

- Insurance House

- Methaq Takaful Insurance Company

- National General Insurance Company

- National Takaful Company (Watania) PJSC

- Noor Takaful

- Oman Insurance Company Orient Insurance PJSC

- Qatar Insurance Company

- RSA Insurance Group

- Salama Islamic Arab Insurance Company

- The New India Assurance Co. Ltd.

- The Oriental Insurance Co. Ltd.

- Tokio Marine Insurance

- Union Insurance Company PSC

How To Choose The Best Car Insurance Company In Dubai?

We share some points to ponder while choosing the Car Insurance Companies in Dubai as mentioned below:

- Insurance comparison is a must thing to consider whether you’re buying comprehensive or Third-party insurance.

- Arrange all required documents for insurance which includes passport, residence visa, driving license, car registration card

- Awareness of how insurance premium is calculated

- Keep in mind that Car Insurance Companies in Dubai also offer Insurance bonuses to their buyers.

- Make sure your car insurance policy includes agency repairs.

- Make sure that your car insurance policy covers emergency services or not.

- Ensure that your insurance premium coverage also includes compulsory excess as it reduces the premium value.

- Consult car insurance consultants like BuyAnyInsurance to get experience advice to select Best Car Insurance Companies in Dubai and good after-sale claim services.

What Do Car Insurance Companies Cover in Your Car Insurance?

Car Insurance Companies in UAE usually covers the following things in their comprehensive car insurance policy as mentioned below:

- Agency Repairs

- Personal Damages

- Roadside Assistance

- Towing Services

- Replacements of Locks

- Windscreen Damage

- Third-party Damage liability

- Car Replacement

Note: However, some of the features mentioned are added in the policy as per the client’s requirement, and it may cost extra as compared to the usual comprehensive car insurance policy. Best Car Insurance Companies in Dubai insurance plans may vary from each other.

Popular Insurance Companies in the UAE

Here are the car insurance companies in UAE that hold a prominent place, once again in alphabetical order:

Adamjee Insurance Company Ltd.

- During 2007 they started their operations in the UAE;

- For the most part, they offer a comprehensive motor insurance policy.

Types of Car Insurance Plans:

Comprehensive Car Insurance

Have your car insured under the All-inclusive Car Insurance plan that protects your passengers. The insurance plan ensures vehicles up to 15 years of age and covers the following:

- Car loss or damage compensation to your Vehicle.

- Third-party liability against personal injury and property damage.

- Third Party Car Insurance

- Their third-party car insurance protects you against your liability towards the third party. The third-party car insurance plan is a prerequisite in UAE.

Additional Benefits

Adamjee Car Insurance offers you the following services through various products (if mentioned on your Policy Schedule) to protect your mobility.

- Compensation of the total cost of your car per purchase invoice in case of total loss (Depreciation will be charged per Authority’s terms and conditions).

- Option of repair at Dealership/Agency/AICL Panel Garage/Premium Garage

- Replacement Vehicle in case of a claim

- 24/7 roadside assistance and breakdown recovery

- Damage caused by Natural Calamities

- Windscreen Damage Coverage

Al Buhaira National Insurance

- Initially, they established in 1978, and their head office is in Sharjah;

- In addition, they have 9 branches across the UAE in Al Hosn, Dubai, Bur Dubai, Abu Dhabi, Alain, Ajman, Fujairah, Khorfakkan.

Types of Car Insurance Plans:

Standard Policy

In addition to the benefits as per the unified wording by the Insurance Authority, you can add the following additional benefits:

- Personal Accident Benefit (Private vehicles)

- AAA (Road Side Assistance)

Gold Policy

- Personal Accident Benefit

- Third Party Property Damage

- AAA (Roadside Assistance)

- Natural Disaster, Storm, Flood

- Strike, Riot & Civil Commotion

- Personal Belongings

- Emergency Medical Expenses

- Windscreen Damage without excess

- Replacement of Locks

- Valet Parking Theft

- Car replacement

- Geographical Extension

Al Wathba National Insurance Co.

- Indeed it is a national insurance company of the UAE, established in 1996;

- In addition, their registered head office is in Abu Dhabi;

- Apart from this, their motor insurance policies are:

- Comprehensive motor insurance (Hemayah)

- Enhanced third-party liability motor insurance

Types of Car Insurance Plans:

Standard Policy

Al Wathba National Insurance Co. The standard policy includes the following:

- Agency Repair: Your insured Vehicle can undergo its repairs in the agency for up to 3 years

- 24/7 Roadside Assistance: Ready to assist you while on the roads 24 hours, seven days a week

- Replacement Car: Enjoy up to 7 days of FREE Replacement Car In the case of a faulty or non-faulty accident.

- Windscreen Damage: In the event of breakage to the insured Vehicle’s windscreen, damages will be restored to new.

- Fire & Theft Cover: In the case of a robbery or fire, your Vehicle is covered and protected.

- Ambulance Service: In the case of an accident, ambulance services will be available upon request and requirement.

- Add Ons

- No Claims Discount: Every year without a claim grants you an additional discount on your insurance premium.

- Breakdown Recovery Service: End breakdowns with their FREE recovery service

- Towing Service: Tow your car at ease with their Free service available at your convenience

- Off Road Assistance: Off-roading just got a lot easier with their FREE Roadside Assistance, valid 24/7

AMAN Insurance

- They are also known as the Dubai Islamic Insurance Reinsurance Company;

- AMAN Insurance incorporated in 2002, and subsequently situated their head office in Dubai;

- Their branches are in Abu Dhabi, Jebel Ali and Sharjah, etc.

Types of Car Insurance Plans:

Most importantly, they provide the following covers against:

- Coverage Against Loss, Damage & Third Party Liability

- Coverage Against Third Party Liability

- Coverage Against Loss, Damage & Third Party Liability / Fleet

- Coverage Marine Hull and Machinery (MD)

- Coverage Against Third Party Liability Fleet

AXA Insurance

Note: Keep in mind that Axa Insurance plans’ features and prices may vary with the passage of time.

Dar Al Takaful

- Dar Al Takaful established in 2008 as an Islamic Insurance Company, hence they provide sharia-compliant solutions;

- They have headquarters in Dubai, as well as locations in Sharjah and Abu Dhabi;

- Most importantly, their products include:

- Motorcar Comprehensive Insurance

- Motor Third Party

Dubai Insurance

- Interestingly, they are the first local insurance company that was formed in Dubai in 1970;

- Furthermore, they offer insurance policies across the Emirates;

- In addition, their car insurance policy provides coverage for:

- Physical damage, in order to protect the policyholder for damage or loss of the insured vehicle under specific circumstances;

- Third-party liability such as death or bodily injury and damages to materials and property.

Types of Car Insurance Plans:

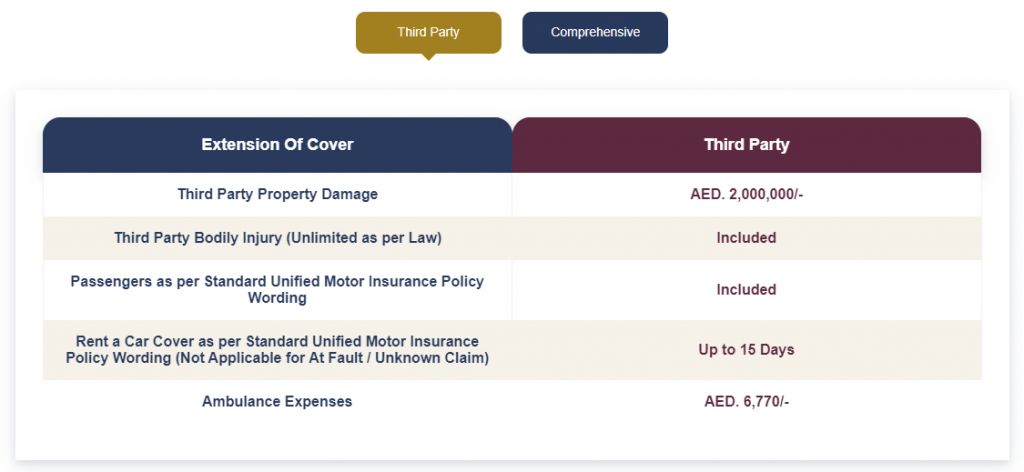

Third-Party Car Insurance:

Note: Keep in mind that Dubai Insurance plans’ features and prices may vary with the passage of time.

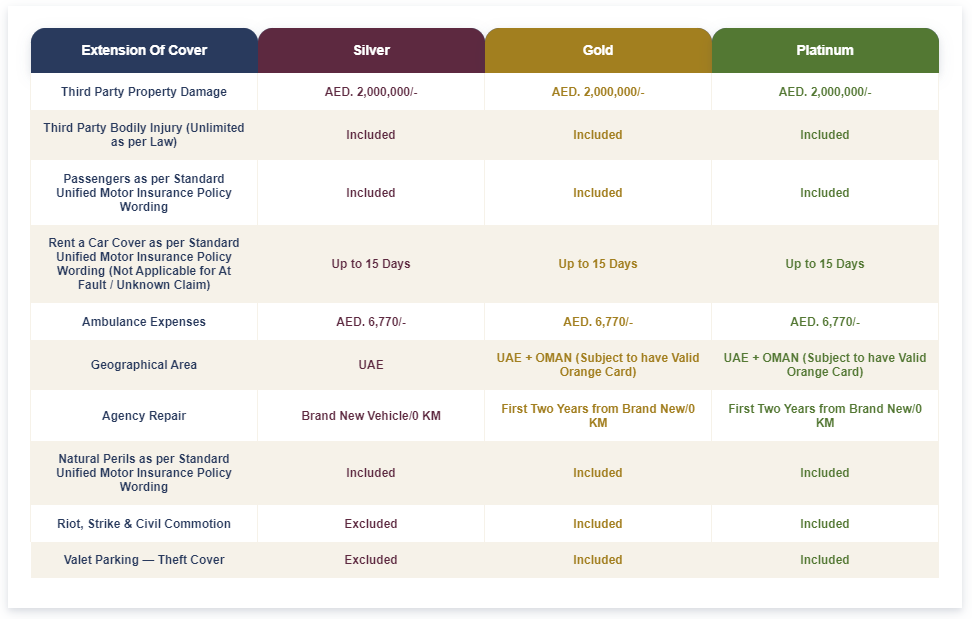

Comprehensive Car Insurance Plans:

Note: Keep in mind that Dubai Insurance plans’ features and prices may vary with the passage of time.

Dubai National Insurance & Reinsurance

- DNIR began operations in 1991;

- They then went on to set up offices in Dubai and Abu Dhabi;

- But most importantly, their motor insurance policies are:

- Loss, damage, and third-party liability

- Third-party liability (TPL) cover

Insurance House

- Insurance House was founded in 2011;

- They have situated their headquarters in Abu Dhabi;

- However, branches are present in Dubai and Sharjah as well;

- Lastly, their motor insurance policies are:

- Loss and damage motor insurance

- Third-party motor insurance

Methaq Takaful Insurance Company

- Methaq Takaful Insurance Company was incorporated in 2008 and they have offices in Dubai as well as Abu Dhabi.

- Motor insurance policy they offer is High Third Party Liability.

- Full-time Help and Support: Methaq Car Insurance provides its clients with full-time help and support and enables them to find answers to their queries whenever they want.

- Cover against Fire and Theft: Methaq Car Insurance has plans to cover fire and theft-related incidents.

- 24-Hour Emergency Roadside Assistance: Methaq Car Insurance provides insured persons with roadside help and assistance through its helpline number – 800 4101. You can call for assistance if your car breaks down or the tank empties.

- Agency Repair Benefits: With Methaq Car Insurance, you also get access to excellent quality agency repair benefits. As soon as the company approves the claim, your Vehicle will be picked up by the agency and returned to you once it’s repaired.

- Third-Party Benefits: The comprehensive car insurance plan of Methaq Car Insurance offers excellent third-party benefits covering all third-party property damages that may have been caused by your Vehicle.

National Takaful Company (Watania)

- They established in 2011 and situated their headquarters in Abu Dhabi.

- However, they have further branches in Abu Dhabi and Dubai.

- Most interestingly, Watania operates using the wakala model.

Types of Car Insurance Plans:

Watania Comprehensive Car Insurance Policy

Comprehensive insurance provides coverage to your Vehicle and its accessories accidentally or unintentionally by you or the driver of your car. Watania Motor Insurance policy also covers any liability towards Third Party Property Damage or Bodily Injury / Death arising from your or your driver’s negligence. Check out the features and benefits of a comprehensive car insurance policy.

Watania Third Party Liability Car insurance

Third-Party Car Insurance protects you against liability towards the third party, be it damage to their Vehicle, property, or bodily injury/death. Check out the benefits and features of the third-party car insurance policy.

Noor Takaful

They established in 2009 in order to provide a broad range of Islamic insurance across the UAE.

Types of Car Insurance Plans:

Their motor insurance policies are:

- Comprehensive car insurance

- Third-party car insurance

Additional Benefits:

With their solutions for Car Takaful, you are not only well covered for loss or damage. Still, you are also assured of quick and efficient claims service to ensure any inconvenience is minimal.

- 24/7 Roadside assistance

- Agency repair

- Driver and passengers cover

- No claims discount

- Free car wash

RSA Insurance Group

- RSA has completed over 60 years in the UAE, ever since they began operations in the year 1956;

- They offer the following motor insurance, from most coverage to basic:

- Executive

- Smart

- Value

Salama Islamic Arab Insurance Company

- Salama is a takaful company founded in 1979 and based in Dubai;

- Branches are also in Sharjah, Abu Dhabi and Al Ain;

- The company and its subsidiaries also operate in Algeria, Egypt, Senegal and Saudi Arabia;

- Their car insurance policies are:

- Motor comprehensive

- Motor third-party

- Vehicle export insurance

Tokio Marine Insurance

- It’s a multinational insurance company, that is part of Mitsubishi;

- Tokio Marine has branches across 38 countries, including the UAE;

- They are operating in the UAE market since 1976, and their offices are in Dubai and Abu Dhabi;

- Their car insurance policies are;

- Million privilege

- Smart plus

- Must car insurance

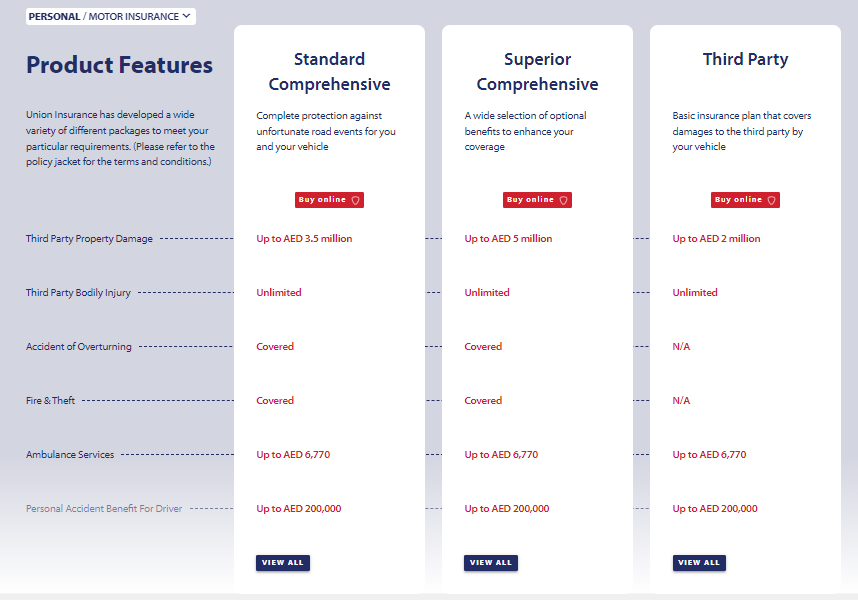

Union Insurance Company

- They established in 1998 and located their corporate office in Dubai.

- Union Insurance motor claims offices are also in Abu Dhabi and Ajman.

Types of Car Insurance Plans:

- Their motor insurance packages are:

- Comprehensive motor insurance

- Affordable motor insurance

How to Successfully Compare Insurance?

Efficiently compare Car Insurance Companies in UAE with the following steps:

Policy

One of the things you should compare between different Car Insurance companies is their insurance policy, for example, is it transparent and easy to understand?

Documentation

Insurance can be hard work, whether you are buying or renewing, however, the claims process is perhaps the most stressful of all. Car Insurance Companies in Dubai must make these processes as simple and easy as possible. Therefore, compare customer service for promptness and ease.

Coverage

While most Car Insurance Companies in UAE offer the same two insurance policies, the difference is in the wording and the benefits. Compare very carefully to see the kind of coverage each provider is giving for comprehensive or third-party insurance because the benefits they offer with each policy can make the world of a difference.

Price

Once the above important comparisons are out of the way, it should be easy to compare the price you are getting for an insurance policy from Best Car Insurance Companies in Dubai.

FAQ

1.Immediately contact the police at 800-4888 toll free number and report the police about the whole incident at first.2.Call your insurance provider instantly.3.Capture the photos of incident with your phone.4.Go through your car Insurance Policy.5.Make an insurance claim on your car insurance policy number.

Car insurance in Dubai costs around 1.25% to 3% of the car value. However, other factors like car model, fuel type, claim history, driver’s age, driving license, etc also affects the car insurance price in Dubai.

It covers the expenses of other party in case of third party insurance. Whereas, a comprehensive car insurance covers both expenses including your damages and of third party. Insurance company pays for all the expenses in case of damages as per the car insurance policy in Dubai.

Bodily injury liability coverage is the most common car insurance in Dubai. Where, car insurance companies covers personal damages occur due an unfortunate incident.

The best car insurance company in Dubai provides competitive premium prices and additional features like towing service, roadside assistance, etc. Examples: Adamjee Insurance, Axa Insurance, Noor Takaful, Oman Insurance, etc.

You can switch insurance anytime, but Be sure to find out if cancellation fees apply before ending your coverage. Please choose a new policy on BuyAnyInsurance.ae and purchase it before canceling your current plan with your insurance provider. It’s as easy as that!

A car insurance company is technically not liable to pay for the damages caused to your car in an accident that you didn’t cause. However, if you have comprehensive car insurance with some additional features, the car insurance company will also cover the damages to you caused due to a car accident.

Car insurance companies in UAE like Adamjee Insurance, Oman Insurance, and Axa Insurance offer the best claim settlement ratio in the UAE. Usually, their settlement ratio lies between 80 to 90 percent.

The RTA makes it mandatory for all car owners to buy car insurance. Furthermore, as per the basic requirement of law, car insurance should cover third party damages including death, injury and damage to property.

This policy covers all damages caused to the third party in the aftermath of a road accident, however, it does not cover any damages to the policyholder and their vehicle.

A comprehensive car insurance policy will protect all entities involved in a car accident. It also covers incidents of theft, vandalism, fire, and more.

The validity of car insurance lasts a year, after which the policy needs renewal. So, make sure to regularly service the car and keep it in the best condition for cheap insurance premiums.

There are several factors which include, but are not limited to, vehicle type, vehicle value, driving experience, driving history, location and age.

Compare & Buy Now On BuyAnyInsurance

- Buy affordable car insurance easily by comparing the largest car insurance companies in UAE. Subsequently, an official insurance policy will be available within an hour of purchase;

- Customers are a priority, and there is no administration fee because honesty, integrity & transparency are our guarantees ;

- Get an insurance policy especially tailored for you by our insurance experts with an experience of 15+ years;

- Our team will extend support 24/7, furthermore, you can continue to enjoy after-sales services too;

Read more…

How to Lower Your Car Insurance Costs in Dubai

Avoid These Top 10 Mistakes When Purchasing Car Insurance

Benefits of Buying Car Insurance Online

Originally published Mar 03, 2020 13:11:19 PM, updated Jun 06, 2024