Cheaper Home Insurance Rates | Factors that Should not Be Ignored

It can be a light bulb moment for everyone that there are certain factors that are in hand to control the insurance rates?

Thus, what factors can they be, that are missed by the majority of the general audience in the UAE?

Home insurance in UAE is getting its fair share of recognition and in some emirates, it is also becoming a mandatory requirement.

Now talking about these cheaper home insurance factors certain dimensions have been identified that can enhance or lower the rates.

In general, home insurance is divided into two distinct parts;

- The insurance of the building itself (fire hazards, water damages, etc.)

- The insurance of its contents (what you own and normally keep inside your house).

There are a lot of reasons why home insurance in Dubai is important, think of it like an umbrella that protects you from unknown risks.

When looking at the statistical data on claims against home insurance in the United Kingdom, the United States of America and the UAE, the principal reasons for claims are, in order of proportional size: fire & lightning damage, bodily injury, property damage, water damage, wind, and hail.

Hence, we have explained what exactly having home insurance in UAE meant and also we listed down factors along with the details that you need to consider while buying insurance.

Home insurance in the UAE

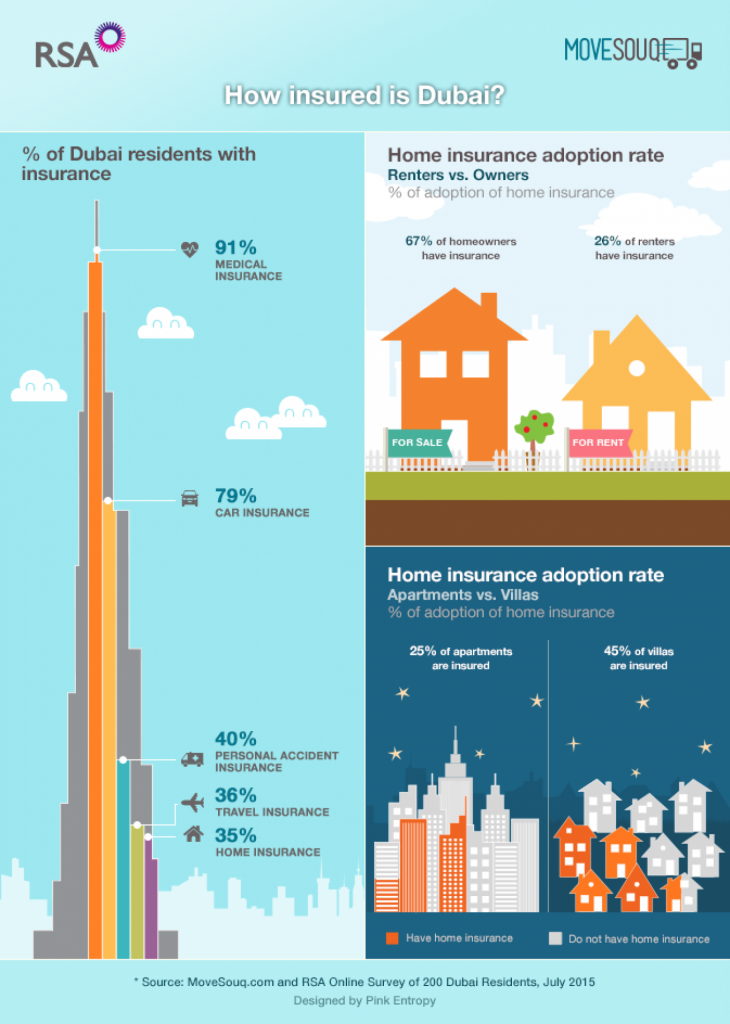

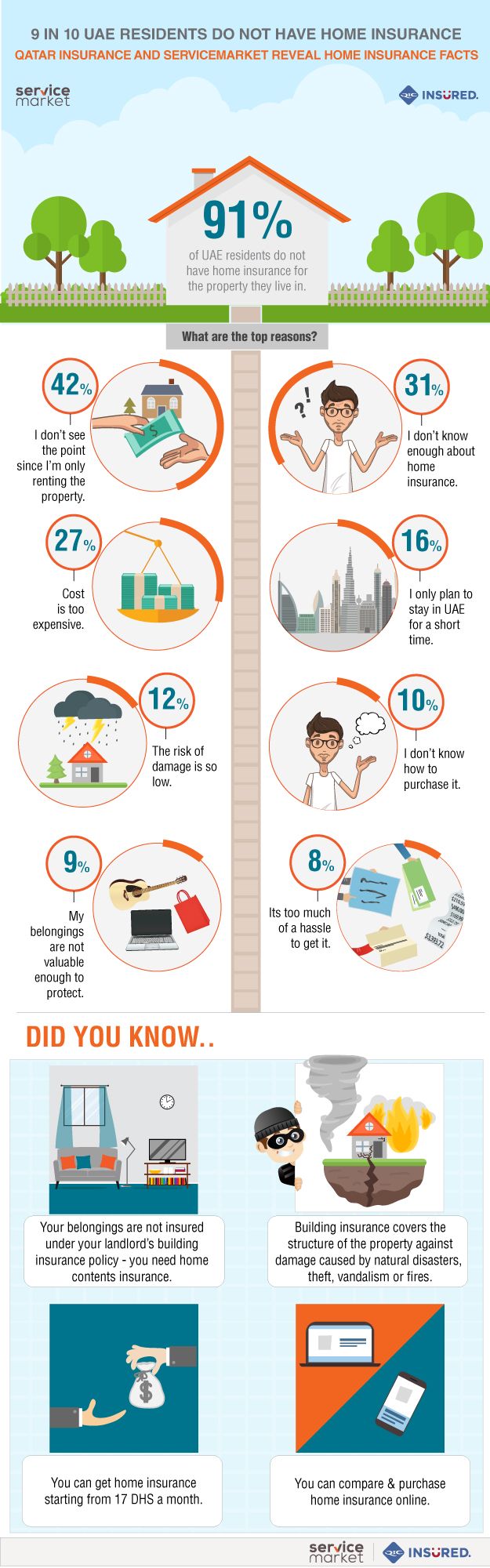

Traditionally, the number of people who buy any kind of home insurance in the United Arab Emirates is quite low.

In December 2019, UAE local newspaper published an article stating that 69.1% of UAE Residents do not have home contents insurance.

The reason behind not having home insurance by the citizens can be many but one thing is clear their lack of awareness on this topic, is letting them comprise their living standard by their own hand.

Therefore, its high time to purchase cheaper home insurance at a surprising rate, just from BuyAnyInsurance guidelines and providers.

- No smoke without fire

There is a distinct upward trend in the number of people choosing to purchase home insurance in Dubai. The reason why?

Well unless you have been living under a rock for the last couple of years, it would have been impossible to miss the number of spectacular fires that struck several skyscrapers.

- The General Command of the Civil Defense stated that 928 fires occurred in Dubai in the first half of 2017 alone; although that was 41% less than the year before, it is still a significant number.

- Residents in some areas can also testify that flood damages are not unheard of in this part of the world; yes, we have few rain episodes here, but our cities’ infrastructures and hour homes are not necessarily well prepared for such events.

- The general trend identified by insurance companies and brokers in the country was that each of these incidents would be followed by an uptick in purchases of home insurance policies.

An article in a local news site highlighted a 100% rise in home insurance sales since one particular fire at Dubai’s Zen Tower.

Therefore incidents happening around people affects the attitude of people regarding insurance.

What type of coverage do you really need?

One of the first questions you have to ask yourself when considering home insurance, particularly contents insurance, is what liability coverage you require. For a typical home in Dubai, there are a variety of considerations that are entirely dependent on your lifestyle and mode of living.

- For example, a family with young children and a live-in maid or nanny living in a villa would have different requirements from a young bachelor living in an apartment.

- While both of these would require contents insurance for their belongings, the family might also wish to avail of additional cover for their nanny, to cover against risks that include medical, injury, sickness or even death and repatriation.

Expats living in Dubai often spend a lot of time out of the UAE.

The amounts of time spent away from home should factor in your research since some insurance policies will not pay against claims if incidents occur while the house in question has been unoccupied for a certain period; thus this period can range from 30 to 120 days in some cases.

Factors of Getting Cheaper Home Insurance Rates in 2024

The location of your home, its construction, and its condition, as well as your credit and claims history, all play a part in how much you pay for home insurance.

Insurance companies assess risk in different ways, so it’s important to compare homeowner insurance quotes to be sure you get the most affordable rate.

Hence, we have identified 16 factors for you that affect home insurance rates in 2022.

1. Replacement cost of your home

What’s perhaps the biggest mistake most homeowners make when insuring their homes?

- Industry experts say that it’s under-insuring the value. Not having enough coverage can lead to financial pain if the worst happens.

- The estimated replacement cost is the amount of money to build the exact same home where it stands now.

- This is different than the market value of the home. Market value includes other things, such as the land’s value.

Thus, what can you do to guarantee you’re covered? You should get an accurate replacement number by hiring a professional appraiser. It is always good to have your own estimate rather than depending on the company to get an estimate.

2. Deductibles you choose for your policy

A deductible is an amount you have to pay toward a loss before your insurance company pays a claim.

- Choosing the right deductible amount is a significant decision. The higher the deductible, the more money you can save on your premiums.

- Depending on where you live, you may have other deductibles to consider when balancing your financial situation with the need to protect your house.

- If you live in a disaster-prone area, your insurance policy may have a separate deductible for certain kinds of damage.

If you live near the coast in the East, you may have a separate windstorm deductible; if you live in a state vulnerable to hail storms, you may have a separate deductible for hail. Hence, if you live in an earthquake-prone area, your earthquake policy has a deductible.

3. Type of dog you own

You love your dog, but insurers may not be quite as enamored.

- The liability portion of your insurance helps to protect you if you’re sued by someone who is attacked or bitten by your dog.

- To qualify for a policy, homeowners may be required to sign liability waivers for dog bites. Other insurers will cover a pet if the owner takes the dog to classes to modify bad habits or if the dog is routinely restrained with a muzzle, chain or cage.

- You should have details about your dog — including its breed and history — ready when discussing your policy needs with an insurance agent.

Thus, you may want to shop around for a policy if you have a dog that’s a so-called “aggressive breed.” Some insurers will increase your rates, while others won’t.

4. Wood-burning stoves

A wood-burning stove can be very atmospheric and reduce energy costs. But they can also raise your homeowner’s insurance premiums.

Thus, you may be able to avoid or reduce premium jumps by providing your carrier with proof that the stove was installed by a licensed contractor and meets code requirements.

5. Home-based business

It is probably a good idea to take steps to protect equipment, supplies and anything else that is attached to your home-based business.

Purchase an “endorsement” to your existing policy. Your insurer may offer an endorsement that adds additional property coverage and some limited liability coverage.

- Buy a specific in-home business policy. Some insurers sell specific in-home business policies with some of the same features as larger commercial policies but with lower policy limits and at a lower premium.

- Also, if you have to close your business because of damage to the home, the in-home policy will cover the income that the business loses and ongoing expenses, such as payroll, for up to one year.

Therefore, the policy provides limited coverage for loss of valuable documents, accounts receivable, offsite business property and use of equipment.

6. Remodeling

Any remodeling, whether it’s a bathroom, kitchen or whatever, will likely raise the home’s value.

With that in mind, you need to have an increased value reflected in your policy. Keep your insurance agent well aware of the status of any improvements.

It is expensive for you to build, and it’s expensive for the insurance company to rebuild in case of a loss.

Hence, materials and construction costs will be taken into consideration and it may increase your premium, but at least your coverage will be up to date.

7. Home liability limits

Personal liability limits should be carefully considered. Most people buy home liability policies with low values.

The amount could easily be used up due to medical expenses and possible lawsuits if someone was seriously injured in your home.

Thus, you should choose the insurance policy with limits of at least a value that would be sufficient for you.

8. Insurance score

Your insurance score, which is similar to your credit score, can significantly affect your premiums, even the ability to secure a policy. People with low insurance scores may be seen as a financial risk by insurers, much the same way lenders look at those with poor credit numbers.

To better ensure a good insurance score, you should these three steps:

- Avoid having debt that is in default.

- Carry modest balances on your credit cards. Be sure to pay them in full each month if possible.

- Never have a tax lien, court judgment, your salary garnished or a bankruptcy on your record.

9. Marital status

Insurers tend to smile at married homeowners. This is because married couples historically file fewer claims than singles and are seen as, possibly, more mature and definitely less of an actuarial risk by insurance companies.

10. Age and construction of your home

The age of your home and how it was constructed are big factors in your home insurance rates. Even your home’s previous claims history can play a part in setting rates.

- Size, location, and new-ness of the construction can all affect the cost to rebuild a home; and that affects the coverage needed.

- People with older houses get higher insurance rates because they will need more renovations.

- It’s possible that an older home may cost more to insure, as the materials [and] features in older homes can be more costly to repair and replace, things like plaster walls, ornate moldings, stained-glass windows, hardwood floors.

- Updates to roofs, plumbing, electrical and heating may positively impact the rate for an older home since these things being upgraded reduce the likelihood of loss.

- Anytime you make a home improvement, you should talk to your insurance agent to be sure you’re covered and realizing any savings that may come along with the improvement.

Thus, other home construction factors can include whether the home is brick or wood, the age of the electrical system and whether the home has smoke detectors, a security system, and a sprinkler system.

11. Having a swimming pool, hot tub or outdoor spa

These nice-to-have features will increase your home insurance rates because you’ll need additional liability coverage in case someone is injured.

Homeowners with swimming pools and other special features, such as spas, should consider an umbrella policy to provide additional protection in the event someone gets injured on your property and decides to sue.

Therefore, knowing such an unknown factor can help to get cheaper home insurance rates

12. Condition of the roof

How good a shape a home’s roof is in will play a factor in your homeowner’s insurance.

The condition of the roof affects your homeowner’s policy.

- New/newer roofs will typically see a reduced premium, while homes with older roofs will pay more.

- Anytime you make a home improvement, especially replacing or repairing a roof, you should talk to your insurance agent to be sure you’re covered and realizing any savings that may come along with the improvement.

- Newer roofs have a better shot of protecting the home against the elements. An older, leaky roof can result in damage within the home.

- Home insurance companies expect the homeowner to keep tabs on the roof and make repairs when needed.

Insurers could even threaten to drop you if you have an old roof. Thus avoid this situation.

13. How close your home is to a fire department

If you live near a fire station, you’ll pay less premium and able to cash cheaper home insurance rates.

- Homes that are located near permanently staffed fire departments usually cost less to insure. And that’s also true for homes located near fire hydrants.

- Urban and suburban homes usually get better ratings for fire protection than rural areas.

Thus, having the fire department nearby will help to keep your home safe in case of fire. And it will also help to lower your home insurance rates, a win-win.

14. How close your home is to coastline or body of water

Homes located near the coast or coastline are generally more expensive to insure than those that are inland.

- Homeowners who live near the coastline may also have a separate deductible for hurricanes or need a separate windstorm insurance policy for their homes.

- Having a home near any body of water could affect home insurance rates because of the risk of flooding.

- Flood damage is not covered by standard home insurance policies.

Thus, you may want to purchase separate flood insurance even if your home isn’t considered a high-risk for flooding.

15. Your credit history

Insurance companies can use your credit history when creating home insurance rates. Each insurance company has its own credit formula, which is different than a credit score.

Thus, your credit history will decide are you eligible to get cheaper home insurance or not.

16. Your claims history

You may have moved into a new home, but the claims you filed at your previous residence will follow you.

Therefore, for cheaper home insurance, there’s a significant correlation between claims that are made and the future additional likelihood of claims being made.

Conclusion

As you can see, insurance companies use multiple factors when setting your home insurance rates.

Hence, in order to get cheaper home insurance, these factors point to the importance of proper knowledge and If you’re not getting quotes from multiple insurance companies, you may be paying too much for your home insurance.

Read Also:

Best 5 Insurance Policy In The UAE That You Must Have

Originally published Jan 16, 2020 10:11:14 AM, updated Jun 06, 2024